October 18th 2018 eFNOLProperty & CasualtyCustomer ExperienceInsurance Claims

Learn More

Learn More

Digital adoption is a gradual process in all industries, and particularly in those with infrequent customer interactions. On average, Personal Lines customers make an insurance claim once every seven years. The chances are the last time they contacted their insurer to report a loss, they did so with a phone call. They probably didn’t use a smartphone for anything other than Googling which number to call.

At RightIndem, we believe this will become a process of the past within the next five years and will go beyond Personal Lines to Commercial Lines, like Marine. Buying insurance by phone has been usurped by online, and Claims will follow. But it will only be a change for good if insurers start with the customer in mind and design a journey that is easier and more enjoyable than the current way of doing things.

Good design is invisible. A great digital Claims experience is one in which eFNOL is painless, there are no glitches, and it’s easy to work out what to do next.

A great digital Claims experience also treats people as ‘claims customers’, not ‘claimants’. We make this important distinction on the basis of customer experience, psychological and behavioural insights.

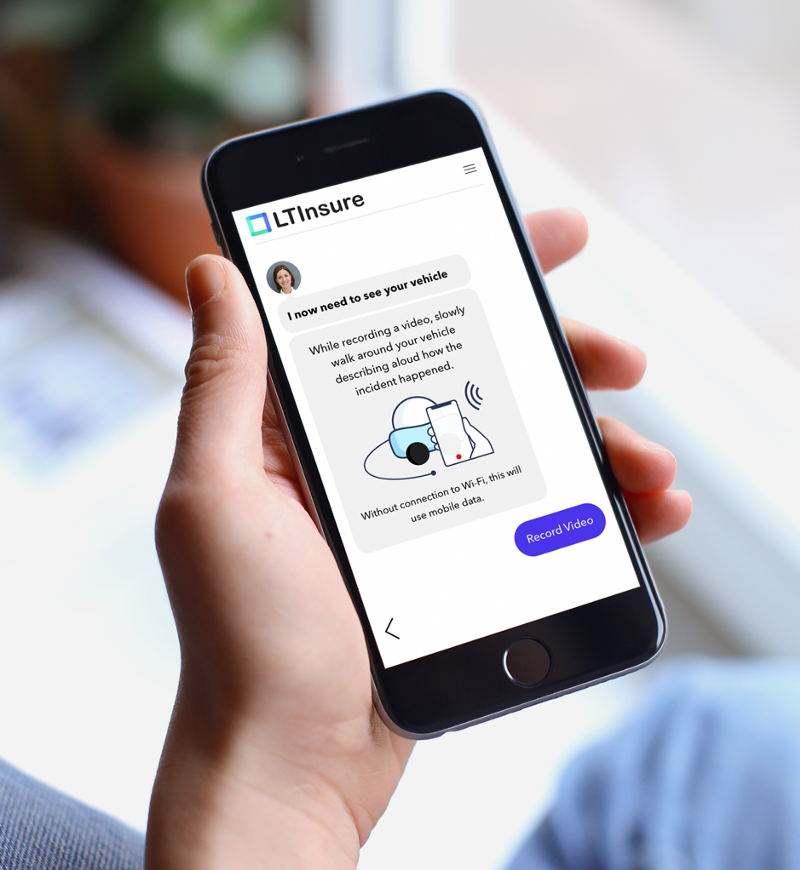

Firstly, digital doesn’t mean devoid of a personal touch. When we ask people to record their Claim digitally, we’re sensitive to their emotive state and offer a human experience, emulating the contact people seek at this time. We know people respond positively to short, concise questions that are asked informally in first person in a polite and friendly tone.

Digital doesn't mean devoid of a personal touch

Our eFNOL guide, Sarah, gently prompts for information while walking the customer through their claim in a considerate but informative manner.

She asks a single question per page, ensuring the customer is never overwhelmed by questions or the need to make several decisions. Answering a question and moving on is intuitive and effortless.

The visual design has a similar look and feel to a messaging app: Sarah asks her question at the top left of the screen, e.g. for a vehicle registration number, and the responses appear on the right-hand side. The familiarity of the format helps our eFNOL to feel like a natural conversation.

Good digital design reduces the burden on the customer during a stressful period

Good digital design is also about reducing manual input from the user. What’s the point in having a smartphone if you’re just using it for the keyboard? Integration with Google Maps and making an audio or video recording of the claim all reduce interaction — and the burden on the customer during a stressful period.

Digital must be delivered through the right channel. In the case of a rare event like a claim, that means delivery through a web portal that is optimised for mobile and accessed via a personalised link, rather than an app. If you ask customers to download an app that they will likely never use, there is a high chance it will have been deleted or forgotten about by the time they come to need it.

An in-page web app is also the easiest way for customers to switch from checking progress on their mobile phone on a lunch break to uploading images using their laptop in the evening, across one seamless platform. Our application offers device hand-off, meaning customers can start their claim from their laptop but hand-over to their smartphone to capture photos and complete their claim from their smartphone.

Some 80 per cent of customers wait until they get home and have regrouped to make a claim, rather than reporting it at the scene of the accident. That’s another reason to make it easy to do on a home computer. Summary: building an app is a distraction.

Finally, it’s important to be realistic about what digital design is hoping to achieve. Customers are experiencing an emotional low at the point of making a claim. According to our analysis of eFNOL calls, the prevalent emotions are sadness, anger and frustration. Our job is to reduce the last two, and elevate the experience to satisfactory, and one that is more pleasurable than dealing with competitor insurers. Let’s face it, making a claim is no one’s idea of fun. From there, we can use digital tools to speed up settlement and resolution of the claim, ultimately leading to happiness and the holy grail of insurance customer satisfaction: recommending their insurer to friends and family.

Insurance is a lagging industry for digital adoption, but it’s important to keep in mind that customers have digital experiences in all other areas of their lives, raising their expectations of a good digital experience and anticipation of how digital should look and feel.

RightIndem is all about delivering digital Claims journeys that people will want to use. However sophisticated the underlying Tech may be, it’s ultimately through clean design and usability that customers benefit.

Share